Mark Zuckerberg net worth 2026 is a topic that captures the attention of many as we look ahead to the future of one of the most influential figures in technology. With a career that began in a Harvard dorm room, Zuckerberg has transformed Facebook into a global powerhouse, significantly impacting his financial journey. As we delve deeper into the factors influencing his net worth and the potential challenges and opportunities that lie ahead, we’ll gain a clearer picture of what 2026 might hold for him.

This exploration will not only highlight the milestones that shaped Zuckerberg’s financial standing but also touch on the economic trends, philanthropic endeavors, and regulatory landscapes that could shape his wealth in the coming years. With technological advancements and market dynamics in play, understanding his financial trajectory is both fascinating and essential.

Understanding Mark Zuckerberg’s Financial Journey and Its Impact on His Net Worth

Mark Zuckerberg’s financial journey is a fascinating tale of innovation, ambition, and strategic decisions that have significantly shaped his wealth over the years. From his early days as a college student developing a social platform to leading one of the world’s most valuable companies, Zuckerberg’s career is marked by key milestones that directly impact his financial standing. This exploration delves into these pivotal moments and their implications for his net worth.The evolution of Facebook, which began as a simple networking site for Harvard students in 2004, has been nothing short of extraordinary.

The platform’s rapid expansion into a global powerhouse has played a crucial role in Zuckerberg’s wealth accumulation. Under his leadership, Facebook transitioned from a startup with limited financial resources to a publicly traded company boasting a market capitalization exceeding $800 billion as of 2023. This meteoric rise has been fueled by a combination of innovative product development, strategic acquisitions, and an adept understanding of digital advertising, which together have created a lucrative revenue model.

Key Milestones Influencing Zuckerberg’s Financial Standing

Several milestones stand out in Zuckerberg’s career, each contributing to the trajectory of his net worth. Understanding these moments provides insight into how he has managed to amass his wealth:

- Creation of Facebook: Launched in 2004, the initial concept was aimed at connecting university students. The site’s user base quickly expanded, which laid the foundation for future growth.

- Initial Public Offering (IPO): Facebook went public in 2012, generating $16 billion in its IPO, which significantly increased Zuckerberg’s wealth, making him a billionaire at just 28 years old.

- Acquisitions of Instagram and WhatsApp: By acquiring Instagram in 2012 for $1 billion and WhatsApp in 2014 for $19 billion, Zuckerberg diversified Facebook’s portfolio, enhancing its market value and revenue streams.

- Global Expansion and User Growth: Facebook’s growth into international markets resulted in user counts soaring into the billions, solidifying its dominance and revenue generation capabilities.

- Emphasis on Virtual Reality and Metaverse: The strategic pivot to the metaverse and investments in Oculus VR reflect Zuckerberg’s forward-thinking approach, positioning him ahead of the curve in technology trends.

Zuckerberg’s wealth has also been bolstered by various investments outside of Facebook. His interests span philanthropic ventures and tech startups, contributing to his financial portfolio. Notably, he co-founded the Chan Zuckerberg Initiative with his wife, Priscilla Chan, which focuses on education, health, and the promotion of equality. This initiative, while philanthropic, also has potential financial returns through strategic investments in technology companies and research ventures.The financial implications of Zuckerberg’s decisions and investments are profound, as they not only influence his personal net worth but also the broader tech landscape.

His foresight in recognizing trends such as social media advertising, mobile computing, and virtual reality has positioned him as a leader, and his wealth reflects the success of these strategic choices. Overall, Mark Zuckerberg’s financial journey illustrates how visionary leadership, strategic decision-making, and timely investments can lead to substantial wealth creation while also shaping the future of technology.

Analyzing the Factors Influencing Zuckerberg’s Net Worth in 2026

As we look ahead to 2026, several economic factors are poised to impact Mark Zuckerberg’s net worth. Understanding these elements is critical in painting a comprehensive picture of his financial future. This analysis will delve into the major economic variables, technological advancements, and social media trends that could significantly influence his wealth.Economic factors play a crucial role in shaping the net worth of high-profile entrepreneurs like Zuckerberg.

Key indicators such as market conditions, inflation rates, and regulatory environments will be significant in this regard. The following are major economic factors that could impact Zuckerberg’s financial position by 2026:

Major Economic Factors Impacting Net Worth

The landscape of the economy will likely be influenced by various interconnected factors. These include:

- Market Volatility: Fluctuations in the stock market can directly affect the valuation of Zuckerberg’s holdings, particularly in Meta Platforms Inc. A downturn could mean a substantial dip in his net worth.

- Inflation Rates: Rising inflation can erode purchasing power, impacting consumer spending and advertising revenues that are vital for social media businesses.

- Global Economic Conditions: Economic growth or recessions in major markets like the U.S., Europe, or Asia can affect Meta’s user growth and revenue streams.

- Regulatory Changes: Increased scrutiny on tech companies regarding data privacy and monopolistic practices could impose fines or operational constraints, impacting profitability.

Technological advancements and evolving social media trends are also pivotal in determining Zuckerberg’s financial trajectory. The way technology integrates into everyday life and the subsequent shift in user behavior can heavily influence Meta’s business model and revenue.

Technology Advancements and Social Media Trends

The evolution of technology and user engagement on social platforms will shape Zuckerberg’s financial outcomes significantly. Key trends and advancements include:

- AI Integration: Incorporating artificial intelligence into user experiences can enhance engagement and advertising efficiency, potentially leading to increased revenue.

- Virtual Reality and Metaverse Development: Investments in VR and the metaverse can create new revenue streams, positioning Zuckerberg and Meta as leaders in emerging digital landscapes.

- Shifts in User Behavior: As younger generations gravitate towards platforms like TikTok, adapting to changing preferences is essential for retention and growth.

- Data Privacy Innovations: Stricter data privacy measures may require changes in monetization strategies, impacting revenue generation capabilities.

Market dynamics often dictate fluctuations in wealth, particularly for individuals with significant investments in publicly traded companies. Understanding these dynamics can provide insight into potential changes in Zuckerberg’s net worth.

Market Dynamics Influencing Wealth Fluctuations

Fluctuations in Zuckerberg’s net worth can stem from various market dynamics as follows:

- Investor Sentiment: Investor perception of tech stocks can lead to rapid valuation changes, affecting Zuckerberg’s stake in Meta.

- Competitive Landscape: The rise of new platforms can lead to increased competition, potentially impacting Meta’s market share and profitability.

- Economic Recession or Boom: A recession could lead to decreased advertising spending, while an economic boom could enhance advertising budgets, significantly influencing Meta’s revenue.

- Technological Disruption: Sudden advancements by competitors could disrupt Meta’s business model, necessitating swift adaptations that might impact financial performance.

Understanding these factors provides a clearer picture of the complexities surrounding Zuckerberg’s financial landscape as we approach 2026.

The Role of Philanthropy in Mark Zuckerberg’s Financial Portfolio

Mark Zuckerberg, co-founder of Facebook and a central figure in the tech industry, has made significant strides in philanthropy, which plays a crucial role in shaping his financial landscape. As one of the wealthiest individuals globally, his charitable endeavors not only reflect his personal values but also serve to influence public perception, which can have lasting effects on his net worth.Zuckerberg’s philanthropic efforts are primarily channeled through the Chan Zuckerberg Initiative (CZI), which he established with his wife, Priscilla Chan.

This organization focuses on advancing human potential and promoting equality in areas such as education, healthcare, and scientific research. The commitment to donating a significant portion of his wealth has positioned Zuckerberg as a leader among billionaire philanthropists, showcasing how giving can coexist with wealth accumulation.

Significant Organizations and Causes Supported by Zuckerberg

Zuckerberg’s philanthropic work spans various causes, each with the potential to impact his financial standing in different ways. The following points illustrate the major areas he supports:

- Education Reform: CZI has invested heavily in education, focusing on personalized learning and improving public school systems. By funding initiatives that enhance educational opportunities, Zuckerberg aims to foster a more educated workforce, indirectly benefiting economic growth and innovation.

- Healthcare Initiatives: The initiative has also funded research in health sciences and initiatives aimed at eradicating diseases. Investments in health can enhance societal well-being, which may lead to a healthier consumer base and higher productivity in the economy.

- Scientific Research: CZI has allocated resources toward scientific endeavors, including studying diseases and developing new technologies. Supporting scientific research can yield breakthroughs that drive economic growth, potentially elevating Zuckerberg’s financial portfolio indirectly.

- Social Justice Movements: By backing various social justice initiatives, Zuckerberg addresses systemic inequalities, which can positively influence public perception of him and his wealth. A favorable public image can enhance a billionaire’s brand, potentially leading to increased business opportunities and financial growth.

Zuckerberg’s commitment to philanthropy is also notable for its scale. In 2015, he and Priscilla pledged to give away 99% of their Facebook shares over their lifetimes, showcasing a long-term commitment to societal betterment.

“We’re not just donating money; we’re investing in the future of humanity,” Zuckerberg stated, emphasizing the strategic nature of their philanthropic efforts.

Public perception of Zuckerberg as a philanthropist can significantly impact his wealth. By positioning himself as a social entrepreneur rather than just a tech billionaire, he cultivates an image that resonates with the values of many. This positive perception can lead to increased investment and collaboration opportunities, further enriching his financial portfolio. Additionally, philanthropy can mitigate criticism surrounding wealth inequality, fostering goodwill among the public and enhancing his business ventures.In conclusion, Mark Zuckerberg’s philanthropic initiatives represent a strategic component of his financial portfolio.

By addressing pressing social issues and actively participating in global betterment, he simultaneously enhances his public image and influences his wealth trajectory.

The Impact of Regulatory Changes on Zuckerberg’s Financial Future

The financial landscape for Mark Zuckerberg, particularly as the founder and CEO of Meta Platforms, Inc. (formerly Facebook), is intricately tied to the evolving nature of government regulations. The increased scrutiny over social media platforms has highlighted the significant impact that legislative changes can have on Zuckerberg’s business ventures and, consequently, his net worth. As regulatory bodies across the globe grapple with issues of data privacy, misinformation, and monopolistic practices, the outcomes of these discussions could have profound implications on Meta’s profitability and Zuckerberg’s financial standing.The potential effects of government regulations on Zuckerberg’s business ventures are multifaceted.

As governments implement stricter data protection laws, such as the General Data Protection Regulation (GDPR) in Europe, Meta may face increased compliance costs that could affect its bottom line. Additionally, the ongoing debates regarding antitrust actions could challenge the company’s operational strategy and market dominance. For example, if major social media platforms are required to divest certain assets or alter their advertising practices due to regulatory pressure, it could lead to a significant reduction in revenue streams.

Key Legislative Issues and Their Effects

Understanding the key legislative issues currently at play is essential to gauge how they could alter Facebook’s profitability. The following points highlight the most pressing regulatory concerns that Zuckerberg and Meta may confront:

- Data Privacy Regulations: New laws aimed at protecting user data may necessitate changes to Meta’s data handling and advertising practices, potentially leading to increased operational costs.

- Antitrust Legislation: The risk of antitrust actions could result in forced changes to Meta’s business model, including potential breakup of business units, which would disrupt revenue generation.

- Content Moderation Laws: Stricter rules on content moderation may require additional investments in moderation technologies and staff, impacting the company’s profit margins.

- Taxation Policies: Changes in global taxation norms, particularly around digital services, could impact Meta’s profitability by increasing its tax liabilities in various jurisdictions.

Regulatory challenges faced by Zuckerberg have not been without their financial consequences. Historical instances, such as the Cambridge Analytica scandal, resulted in fines and public backlash that temporarily affected stock prices. Moreover, ongoing investigations and legal battles have diverted resources and attention, impacting long-term strategic planning. Each regulatory challenge brings with it the potential for financial repercussions, as seen when Meta’s stock experienced volatility in response to negative news regarding policy compliance.

“The future of Zuckerberg’s financial landscape may heavily depend on how effectively Meta navigates the complex web of regulatory changes.”

The interplay of regulation and business strategy will undoubtedly be a critical area of focus for Zuckerberg as he seeks to maintain his position and net worth in an increasingly regulated environment.

Predicting Zuckerberg’s Wealth Growth Strategies Leading to 2026

Mark Zuckerberg’s journey in the tech industry has positioned him as one of the wealthiest individuals globally. As we look towards 2026, it is essential to consider the strategies he might adopt to further enhance his net worth. Given the rapid evolution of technology and market dynamics, his approach will likely involve diversification, innovation, and adaptability.Zuckerberg has continuously demonstrated a keen understanding of market trends and consumer behavior.

By leveraging these insights, he can identify lucrative investment opportunities that align with emerging technologies. The rationale behind diversification is to mitigate risks associated with market volatility while maximizing potential returns across various sectors. This can include investments in artificial intelligence, virtual reality, and renewable energy, which are anticipated to grow significantly in the coming years.

Diversification of Business Investments

Diversification is a critical strategy for enhancing Zuckerberg’s wealth, as it allows for stable growth even in fluctuating markets. By expanding his investment portfolio, he can tap into various industries, thus spreading risk and increasing potential returns. Here are a few avenues where Zuckerberg might focus his diversification efforts:

- Investing in emerging tech startups that offer innovative solutions, particularly in AI and machine learning, which are expected to transform numerous sectors.

- Exploring opportunities in the healthcare sector, including telemedicine and biotechnology, which have gained momentum post-pandemic.

- Engaging in sustainable businesses that prioritize environmental responsibility, aligning with global trends towards green energy and sustainability.

Each of these areas not only presents substantial growth potential but also aligns with societal shifts and technological advancements.

Importance of Innovation and Adaptability

Innovation is the backbone of sustained financial success in the tech industry. Zuckerberg’s ability to foresee and adapt to changes in technology and consumer preferences will be vital in maintaining and enhancing his wealth. The significance of innovation can be highlighted in several ways:

- Continual improvements in product offerings, such as enhancing user experience on platforms like Facebook and Instagram through new features and functionalities.

- Investing in research and development to stay ahead of competitors and lead in industry trends, ensuring relevance in a rapidly changing market.

- Adopting agile business practices that allow for quick pivots when market conditions shift, thereby capitalizing on new opportunities as they arise.

As Zuckerberg continues to innovate and adapt, he positions himself to not only sustain his wealth but to potentially increase it significantly by 2026.

“The ability to innovate and adapt is what separates successful entrepreneurs from the rest.”

Comparing Zuckerberg’s Net Worth to Other Tech Giants by 2026

As we approach 2026, the landscape of technology and its leading figures continues to evolve. Mark Zuckerberg, the co-founder of Facebook, now Meta Platforms, is projected to have a significant net worth that places him among the top tech titans. Comparing his financial standing with other prominent figures in the tech industry provides a clearer picture of his position and influence.When examining the net worth of tech giants, several key metrics and parameters come into play.

These include revenue growth, stock performance, investment in innovative technologies, and overall market capitalization. For instance, the valuation of companies like Apple, Amazon, and Google, along with their respective leaders—Tim Cook, Jeff Bezos, and Sundar Pichai—offers insights into how Zuckerberg’s wealth stands relative to theirs.

Projected Net Worth Comparison of Tech Leaders in 2026

To illustrate the financial landscape among tech executives, we can look at projected net worth figures for 2026. This comparison is crucial, as it not only highlights individual wealth but also the collective influence these leaders have on the tech industry and beyond.

| Tech Leader | Company | Projected Net Worth (2026) |

|---|---|---|

| Mark Zuckerberg | Meta Platforms | $110 Billion |

| Jeff Bezos | Amazon | $180 Billion |

| Tim Cook | Apple | $120 Billion |

| Sundar Pichai | Alphabet (Google) | $85 Billion |

| Elon Musk | Tesla/SpaceX | $230 Billion |

This table highlights the projected net worth of various tech leaders in 2026. Notably, Elon Musk is anticipated to maintain his position as the wealthiest individual in the tech sector, thanks to Tesla’s continued dominance in the electric vehicle market and SpaceX’s advancements in space technology. In comparison, Zuckerberg is expected to secure a prominent position, particularly as Meta evolves and monetizes its virtual reality and augmented reality ventures.The metrics of stock performance and company valuations offer a deeper understanding of each leader’s financial standing.

Zuckerberg’s wealth is greatly influenced by Meta’s ability to adapt and innovate in a rapidly changing digital landscape, focusing on initiatives like the metaverse, while other leaders also face their unique challenges and opportunities, revealing the competitive dynamics within the tech industry.

Exploring the Societal Impact of Zuckerberg’s Wealth on Global Economy

Mark Zuckerberg’s wealth has grown exponentially over the years, profoundly influencing global economic trends and societal structures. As one of the wealthiest individuals on the planet, his financial decisions and philanthropic efforts have significant implications not just for his immediate business ventures but for a broader economic landscape. This exploration delves into how his net worth reshapes economic dynamics and prompts discussions around social responsibilities.

Influence of Wealth on Economic Trends, Mark Zuckerberg net worth 2026

Zuckerberg’s net worth acts as a barometer for several economic trends, reflecting shifts in technology, investment patterns, and consumer behavior. His wealth stimulates investments in the tech sector, encouraging others to follow suit and thus fostering innovation and growth in emerging markets. The following elements illustrate this impact:

-

The rise of tech startups: Zuckerberg’s success story inspires entrepreneurship, leading to a surge in tech startups, particularly in Silicon Valley and other tech hubs worldwide.

- Global investment flows: As Zuckerberg invests in various sectors, from artificial intelligence to renewable energy, it attracts global investors looking to capitalize on similar opportunities.

- Market valuations: His financial success influences market valuations, prompting higher stock prices for tech companies and affecting overall market trends.

Social Responsibilities of Wealth

With immense wealth comes immense responsibility. Zuckerberg’s financial decisions are increasingly scrutinized, especially regarding his role in addressing social challenges. Wealthy individuals like him are often expected to contribute to societal well-being, which can be observed through various initiatives and philanthropic efforts. Notable points include:

- Philanthropic ventures: Zuckerberg and his wife, Priscilla Chan, founded the Chan Zuckerberg Initiative, focusing on education reform, healthcare, and scientific research. Such initiatives aim to tackle pressing social issues.

- Community investments: His investments in local programs and initiatives, particularly in areas affected by economic decline, help foster community growth and resilience.

- Advocacy for social causes: Zuckerberg frequently engages in discussions about privacy, social media ethics, and the digital divide, using his platform to advocate for change.

Examples of Economic Shifts Driven by Wealth

The financial decisions made by Zuckerberg not only impact his businesses but also have broader implications for economic shifts and societal change. Here are some examples that exemplify this relationship:

- Investment in sustainability: By committing to renewable energy projects, Zuckerberg influences the market towards more sustainable practices, driving a shift in corporate responsibility among other tech giants.

- Promotion of digital education: His funding of educational technology and initiatives promotes digital literacy, impacting workforce development and preparing future generations for a tech-driven economy.

- Global health initiatives: Through his philanthropy, Zuckerberg supports projects aimed at eradicating diseases, which can lead to improved economic conditions in affected regions, thereby contributing to global economic stability.

Ending Remarks: Mark Zuckerberg Net Worth 2026

In conclusion, as we analyze Mark Zuckerberg’s net worth in 2026, we uncover the intricate tapestry of innovation, philanthropy, and economic factors that define his financial future. By examining his strategies and the societal impacts of his wealth, we gain insights into how a single individual can influence global trends. As the landscape of technology continues to evolve, so too will Zuckerberg’s approach to sustaining and growing his wealth, making it a topic worth following closely.

FAQ Summary

How has Mark Zuckerberg’s net worth changed over the years?

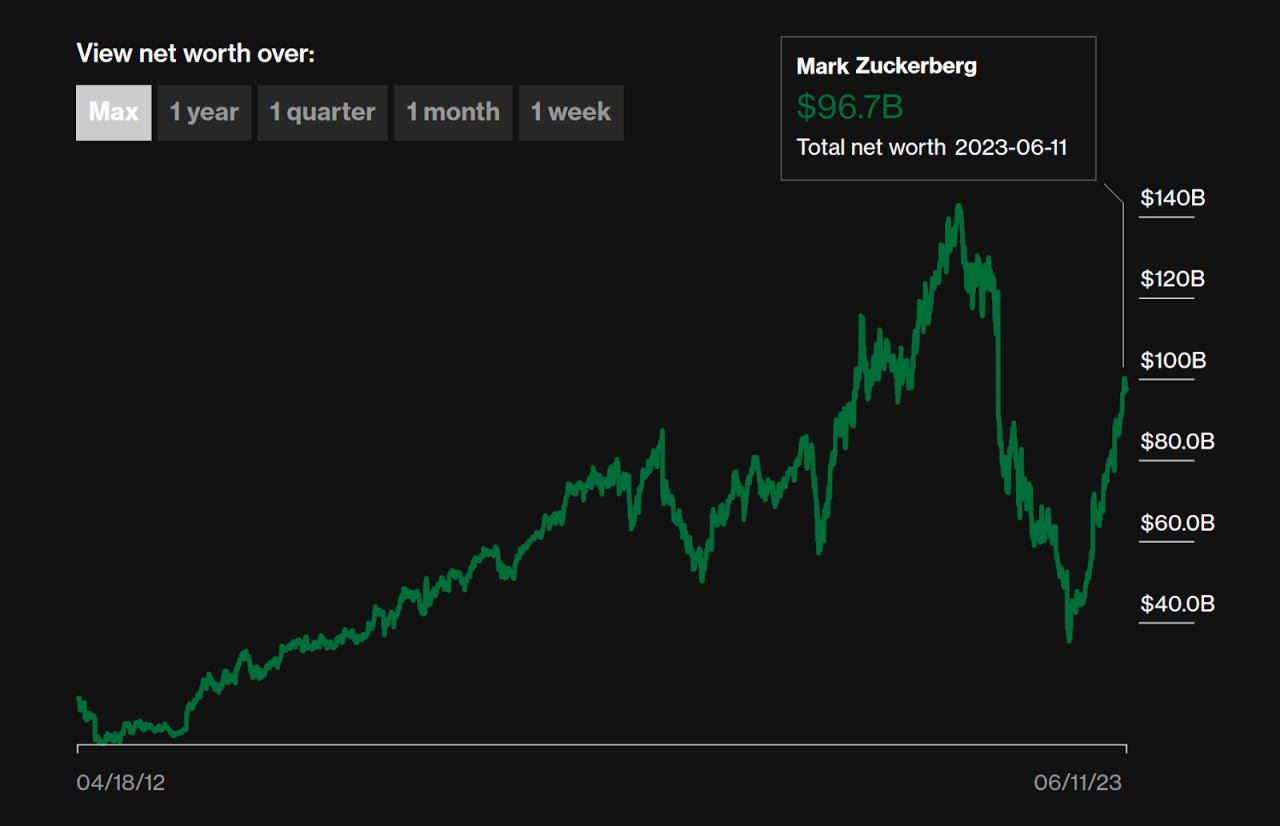

Mark Zuckerberg’s net worth has seen significant fluctuations, particularly driven by Facebook’s stock performance, major business decisions, and investments.

What are some major investments made by Zuckerberg?

Zuckerberg has invested in various startups and initiatives, including in sectors like VR, AI, and renewable energy.

How does philanthropy affect Zuckerberg’s net worth?

While philanthropic efforts may reduce his liquid assets, they often enhance his public image and can lead to long-term financial benefits.

What economic factors could influence Zuckerberg’s wealth?

Economic conditions such as inflation, market stability, and consumer behavior will play crucial roles in shaping his net worth.

How does Zuckerberg’s wealth compare to other tech leaders?

Comparisons with other tech giants reveal insights into market trends and competitive positioning among leading figures in the industry.