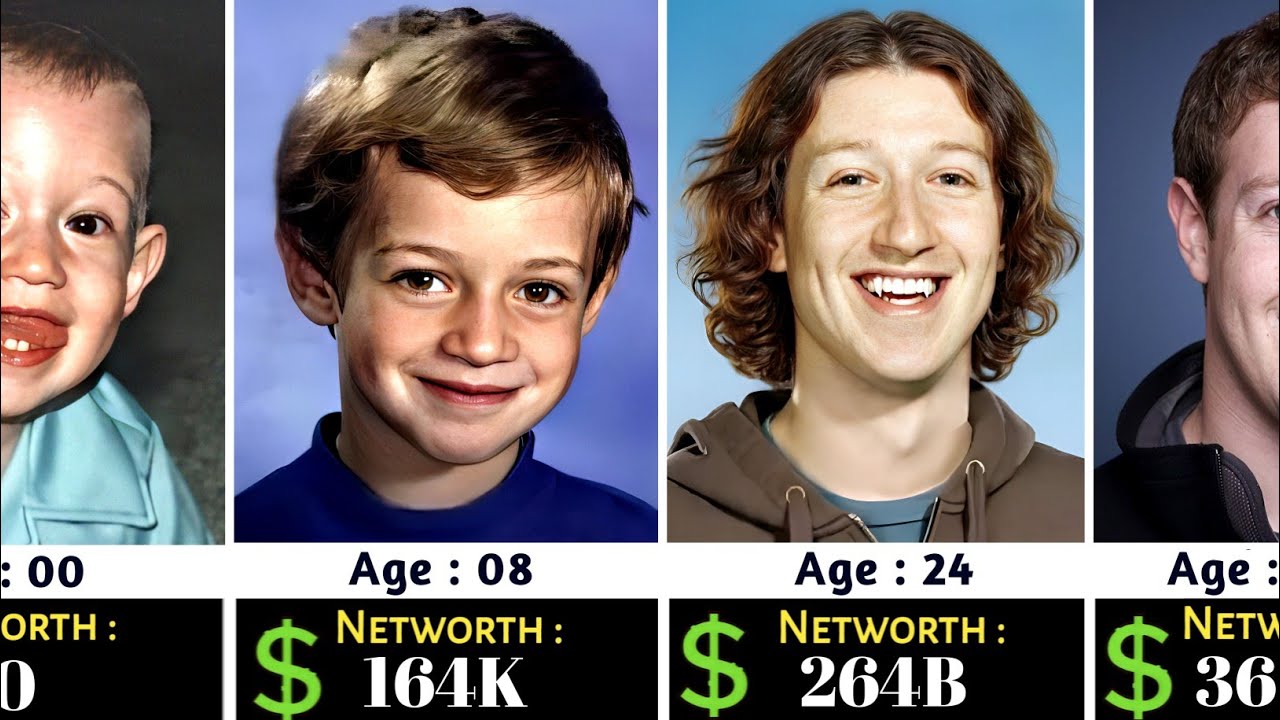

With Mark Zuckerberg net worth 2026 at the forefront, this discussion unveils an intriguing narrative surrounding the financial landscape of one of the world’s most recognized tech leaders. As the founder of Facebook, now known as Meta Platforms, Inc., Zuckerberg’s wealth is influenced by a myriad of factors, ranging from economic trends to personal investments.

This exploration dives into the performance of Meta, the impact of philanthropy, and predictions about technology advancements that could shape Zuckerberg’s financial future. By assessing these elements, we can gain a clearer picture of what his net worth might look like in the coming years.

Analyze the factors influencing Mark Zuckerberg’s net worth projection for 2026

As we look ahead to 2026, various factors are poised to influence Mark Zuckerberg’s net worth. The technology landscape is constantly evolving and, as the co-founder of Meta Platforms, Zuckerberg’s financial standing is closely tied to broader economic trends, industry developments, and his strategic business decisions. Understanding these elements can provide insight into how his wealth might grow or fluctuate in the coming years.One major factor affecting Zuckerberg’s net worth is the ongoing growth of the technology sector, particularly in areas like artificial intelligence (AI), virtual reality (VR), and augmented reality (AR).

As Meta continues to invest heavily in the metaverse, which integrates these technologies, the potential for revenue generation through new platforms and services could significantly enhance Zuckerberg’s financial profile. Additionally, the rising importance of social media, alongside advertising revenue trends, will also play a crucial role in shaping Meta’s profitability.

Economic and industry trends contributing to financial growth

Multiple economic and industry trends are expected to influence Zuckerberg’s net worth, including the increasing digitalization of businesses, growth in online advertising, and the emergence of new technologies.

- The shift towards remote work and virtual interactions has accelerated the demand for social media platforms and collaborative tools.

- The overall growth of online advertising, spurred by e-commerce, continues to be a significant revenue stream for Meta.

- Investments in AI and machine learning are transforming how companies engage with customers, potentially leading to higher efficiency and profits.

- Global economic recovery post-pandemic is expected to boost consumer spending and advertising budgets, benefiting Zuckerberg’s ventures.

Another influencing aspect is Zuckerberg’s strategic investments and business decisions. His focus on diversifying Meta’s offerings, such as expanding into e-commerce and enhancing privacy features, could result in additional revenue streams.

Key investments and business decisions impacting wealth

Zuckerberg’s investments are pivotal in shaping his financial future, particularly in the realms of technology and innovation.

- The acquisition of companies focusing on AI and VR technologies enhances Meta’s capabilities and market reach.

- Investments in sustainable technology initiatives align with consumer demand for eco-friendly practices, potentially mitigating regulatory pressures.

- Meta’s strategic partnerships with other tech firms can open up new revenue channels.

- Continued development of the metaverse is seen as a long-term investment that could redefine social interactions and commerce.

Lastly, market competition and regulatory changes are critical areas that could significantly influence Zuckerberg’s net worth. The tech industry is rapidly evolving, and increased competition from other platforms can impact market share and profitability.

Market competition and regulatory changes influencing net worth

Both competitive pressures and regulatory environments are essential considerations for Zuckerberg’s financial trajectory.

- Emerging platforms offering alternative social media experiences may challenge Meta’s dominance, necessitating innovation and adaptation.

- Regulatory scrutiny regarding data privacy and antitrust issues could lead to potential fines or operational changes, impacting profitability.

- Global regulatory trends, particularly in Europe and the U.S., could influence Meta’s business model and operational strategies.

- Public sentiment and trust in social media companies can significantly affect user engagement and advertising effectiveness.

As these factors come into play, they will undoubtedly shape the landscape in which Mark Zuckerberg operates, influencing his net worth heading into 2026.

Explore the role of Facebook’s (Meta Platforms, Inc.) performance in determining Mark Zuckerberg’s net worth

The financial health and stock performance of Meta Platforms, Inc., formerly known as Facebook, play a crucial role in shaping Mark Zuckerberg’s net worth. As a significant shareholder, changes in the company’s market valuation directly impact his wealth. Understanding this correlation provides insight into how Zuckerberg’s finances are influenced by the company’s performance and strategic decisions.The relationship between Facebook’s stock performance and Zuckerberg’s net worth is highly intertwined.

Zuckerberg’s wealth is largely derived from his ownership stake in Meta, which has seen its ups and downs in the stock market. For instance, a surge in Meta’s stock price following strong quarterly earnings reports typically boosts Zuckerberg’s net worth significantly. Conversely, declines, often triggered by regulatory scrutiny or shifts in user engagement, can lead to substantial decreases in his wealth.

Correlation between Facebook’s Stock Performance and Zuckerberg’s Wealth

The fluctuations in Facebook’s stock price can serve as a barometer for Zuckerberg’s financial status. Here are key insights regarding this correlation:

- The value of Zuckerberg’s holdings: As of recent data, Zuckerberg owns roughly 13% of Meta’s shares. This means that any increase or decrease in Meta’s stock directly translates to a proportional change in his net worth.

- Stock performance trends: In the past, significant events such as product launches, changes in advertising policies, or user privacy concerns have affected Meta’s stock price, illustrating the volatility linked to Zuckerberg’s wealth.

- Market capitalization: As Meta’s market cap fluctuates, it reflects investor sentiment and can lead to major changes in Zuckerberg’s financial portfolio.

The company’s various revenue streams, primarily from advertising, also play a pivotal role in determining its stock performance. As Meta continues to innovate and expand its product offerings, it can further solidify its financial standing.

Company’s Revenue Streams and Growth Potential through 2026

Meta’s revenue generation is largely dominated by advertising, but it has several additional streams that contribute to its overall financial health. Understanding these revenue streams is essential to gauge its potential growth:

- Advertising revenue: This remains the primary income source for Meta, accounting for over 97% of its total revenue. With increasing demand for digital advertising, especially on platforms like Instagram and Facebook, it holds significant growth potential.

- Subscription services: As Meta explores options through services like Facebook Premium and Instagram subscriptions, diversifying revenue can reduce reliance on ad revenue.

- Virtual Reality and Metaverse investments: Meta’s long-term vision focuses on the metaverse, which could transform user engagement and open new revenue channels if successful.

In light of these revenue avenues, projections suggest that Meta could achieve substantial growth through innovative advertising solutions and immersive experiences in the metaverse by 2026.

User Engagement and Platform Innovation’s Financial Impact

User engagement levels and the company’s commitment to innovation significantly influence Meta’s financial performance. Increased user engagement typically leads to higher ad revenue, while innovation can attract new users and retain existing ones.

- Enhanced user experience: Continuous improvements and updates to the platform can drive higher engagement rates, resulting in increased advertising revenues.

- New features and tools: The introduction of features like Reels and Shops has not only improved user retention but also attracted advertisers by providing new avenues for ad placements.

- Expansion into emerging markets: By focusing on user acquisition in developing regions, Meta can broaden its user base and, consequently, its revenue potential.

As Meta continues to innovate and adapt to user needs, the company is likely to see a positive impact on its financial metrics, ultimately influencing Zuckerberg’s net worth positively.

Discuss potential philanthropic activities by Mark Zuckerberg and their impact on his net worth

Mark Zuckerberg, co-founder of Facebook, has made headlines not only for his role in the tech industry but also for his philanthropic efforts. His commitment to giving back has evolved significantly over the years, with various initiatives reflecting his priorities and values. Understanding how these charitable activities influence his financial standing and public image is crucial in assessing his overall impact on society and the business landscape.One of the most notable philanthropic initiatives is the Chan Zuckerberg Initiative (CZI), which he co-founded with his wife, Priscilla Chan, in 2015.

The organization focuses on advancing human potential and promoting equality through investments in education, science, and community development. By pledging to give away 99% of their Facebook shares during their lifetimes, Zuckerberg has set a powerful example in the realm of philanthropy, though such a commitment also brings financial implications. While it can diminish their liquid net worth, it simultaneously allows for potential future gains through increased public support and goodwill.

Examples of Past Philanthropic Initiatives and Financial Implications

Zuckerberg’s philanthropic journey includes several impactful projects:

- The Chan Zuckerberg Initiative: With an initial investment of approximately $45 billion, CZI aims to invest in innovative projects that can change the way we approach education and health care. This commitment, while significantly reducing his stake in Facebook, may enhance his reputation, potentially leading to increases in stock value as public perception shifts positively.

- Education Initiatives: In 2017, CZI launched a $5 billion fund directed towards improving education in the U.S., which has led to collaborations with various educational institutions and technologies. Such investments, while costly, have the potential to yield long-term societal benefits that indirectly favor Zuckerberg’s business endeavors.

- COVID-19 Response: In 2020, Zuckerberg and Chan pledged to donate $25 million to the WHO for COVID-19 relief. This swift action not only showcased their commitment to global health but also reinforced their brand as socially responsible leaders, which can bolster user engagement and trust in their platforms.

The financial implications of these initiatives are multifaceted. While philanthropy can reduce an individual’s net worth temporarily, it often cultivates goodwill, paving the way for future opportunities. Public perception is largely influenced by such charitable actions, as they can enhance an individual’s or a corporation’s reputation significantly.

“Philanthropy can transform public perception and open doors to new business opportunities, all while fostering a positive societal impact.”

Zuckerberg must navigate the delicate balance between philanthropy and wealth accumulation. By strategically aligning his philanthropic efforts with his business goals, he can harness the benefits of both realms. For instance, investing in education not only contributes to societal betterment but also develops a skilled workforce, which can directly benefit Facebook and its future innovations.In conclusion, Mark Zuckerberg’s philanthropic activities reflect a commitment to societal progress that, while impacting his net worth, also enhances his public image and opens avenues for future endeavors.

Balancing these aspects will be crucial as he continues to navigate his dual role as a tech mogul and a philanthropist.

Investigate the technology sector predictions that could influence Mark Zuckerberg’s wealth in 2026

As we look forward to 2026, the landscape of the technology sector is evolving rapidly, and Mark Zuckerberg’s investments are poised to shape his financial future significantly. This period is characterized by dramatic advancements in various technologies, all of which could have a profound impact on Zuckerberg’s wealth. Understanding these trends will provide insight into how his ventures might flourish in the upcoming years.One of the most significant areas of investment for Zuckerberg is in emerging technologies such as virtual reality (VR), augmented reality (AR), and artificial intelligence (AI).

These technologies not only enhance user engagement but also open new revenue streams that could exponentially increase Zuckerberg’s net worth. The integration of these technologies into platforms like Meta (formerly Facebook) is a part of a broader strategy to create immersive social experiences that may redefine online interaction.

Investments in Emerging Technologies

Zuckerberg is making strategic investments in several emerging technologies that could yield substantial returns by 2026. These investments are vital for Meta’s growth trajectory and could enhance Zuckerberg’s wealth significantly.

Artificial Intelligence

AI is at the forefront of Zuckerberg’s technology strategy. By leveraging advanced machine learning algorithms, Meta aims to optimize ad targeting and improve user experience, thus increasing overall revenue. The global AI market is expected to reach $390 billion by 2025, showcasing the potential for substantial returns on these investments.

Virtual Reality and Augmented Reality

With the development of the Metaverse, Zuckerberg is heavily investing in VR and AR technologies. This digital realm is anticipated to be a multi-trillion-dollar market, creating new opportunities for social media engagement, virtual commerce, and entertainment. The success of products like Oculus VR headsets could cement Zuckerberg’s financial standing.

Blockchain Technology

Zuckerberg’s interest in cryptocurrency and blockchain could lead to innovations in digital payments on Meta’s platforms. As blockchain technology grows, it could provide new monetization avenues that enhance user trust and security, further driving up Meta’s valuation.The advancements in these sectors not only highlight the potential for monetary gain but also demonstrate a shift in Zuckerberg’s business strategy towards a more immersive and integrated digital experience.

Significance of Partnerships and Collaborations

Strategic partnerships are crucial for expanding Zuckerberg’s business portfolio and enhancing the value of his investments. Collaborations with leading tech firms, research institutions, and even governmental bodies can accelerate innovation and market penetration.

Industry Collaborations

Partnerships with companies like Microsoft and Google can facilitate resource sharing and technological advancements. This synergy often leads to breakthroughs that bolster Meta’s capabilities in AI and VR, keeping the company ahead of competitors.

Research Partnerships

Collaborating with academic institutions can drive innovation in AI and machine learning. Access to cutting-edge research and talent can enhance product development and lead to earlier market entry for new technologies.

Joint Ventures

Creating joint ventures with startups specializing in emerging technologies can diversify Meta’s portfolio. This approach allows for risk-sharing and leveraging specialized expertise, enhancing the likelihood of successful innovation.In summary, the confluence of emerging technologies, strategic collaborations, and Zuckerberg’s vision for the future positions him to potentially increase his wealth significantly by 2026. The technology sector is a dynamic landscape, and understanding these investments will be crucial to predicting financial outcomes.

Compare Mark Zuckerberg’s net worth trends with other tech billionaires as of 2026

As of 2026, Mark Zuckerberg’s net worth reflects a complex interplay of factors influencing the tech sector, placing him among the wealthiest individuals in the industry. Understanding his financial trajectory requires a comparative lens, looking at how it aligns and diverges from other prominent figures like Elon Musk and Jeff Bezos. Zuckerberg’s net worth has experienced significant fluctuations, attributed largely to market dynamics, company performance, and broader economic conditions.

Unlike Musk, whose wealth is heavily tied to the volatile stock of Tesla, Zuckerberg’s fortune is more stable, primarily derived from Meta’s steady growth in advertising revenue and innovations in virtual and augmented reality.

Comparative Analysis of Tech Billionaires’ Wealth

An overview of the net worths of some leading tech billionaires provides valuable context for Zuckerberg’s financial standing. As of 2026, the following individuals are noteworthy for their significant wealth and influence:

- Elon Musk

-Estimated net worth: $230 billion. Musk’s wealth is closely tied to the performance of Tesla, SpaceX, and his ventures into renewable energy, which have seen substantial growth. - Jeff Bezos

-Estimated net worth: $180 billion. The founder of Amazon has seen fluctuations in his net worth, primarily influenced by changes in e-commerce and cloud computing sectors. - Bernard Arnault

-Estimated net worth: $170 billion. While not a tech entrepreneur in the traditional sense, his influence in luxury goods through LVMH has made him a key player in the wealth rankings. - Bill Gates

-Estimated net worth: $120 billion. Gates’ investments and philanthropic efforts have impacted his wealth trajectory, differentiating him from more active tech entrepreneurs. - Mark Zuckerberg

-Estimated net worth: $110 billion. Zuckerberg’s focus on Meta’s metaverse strategy has positioned him uniquely within the tech landscape.

This comparison illustrates the competitive nature of wealth accumulation among tech leaders. Different market dynamics play crucial roles in their financial trajectories. For instance, Musk’s industry is often subject to rapid fluctuations due to investor sentiment and technological advancements, leading to significant swings in his net worth. In contrast, Zuckerberg’s approach has focused on integrating social media with emerging technologies, providing a relatively stable revenue stream.

The tech industry’s volatility creates a unique environment where billionaires’ net worth can rise or fall dramatically based on market conditions and innovation cycles.

Overall, Zuckerberg’s financial trajectory demonstrates a blend of innovation and stability, setting him apart from other tech billionaires. His strategic pivot towards new technologies, including the metaverse, showcases his adaptability in a rapidly changing landscape, contributing to both his wealth and influence.

Evaluate the impact of global events on Mark Zuckerberg’s net worth outlook for 2026

The net worth of Mark Zuckerberg, co-founder of Meta Platforms, is intricately linked to global economic conditions, geopolitical tensions, and the dynamic landscape of social media. As we look toward 2026, understanding how these factors may play a role in shaping his wealth is crucial. Geopolitical issues and global economic shifts present significant influences on Zuckerberg’s financial future. Economic downturns, trade disputes, or regulatory changes can directly impact Meta’s advertising revenue, which is a key driver of Zuckerberg’s net worth.

For instance, a recession might lead to decreased ad spending from businesses, resulting in lower income for the platform.

Geopolitical Issues and Economic Shifts

The influence of geopolitical tensions and economic fluctuations is crucial for assessing Zuckerberg’s financial outlook. These factors can create both risks and opportunities for his business. Here are some key points to consider:

- Regulatory Challenges: Increased scrutiny from governments worldwide regarding data privacy, misinformation, and market monopolization could lead to stricter regulations, potentially affecting Meta’s operational costs.

- Market Access: Tensions between the U.S. and other nations, especially in terms of trade, could limit Meta’s ability to access critical markets, leading to reduced growth prospects in key regions.

- Currency Fluctuations: Global economic shifts can result in volatile currency exchange rates, impacting revenue from international markets, which is a significant portion of Meta’s income.

- Investment Climate: Political instability in major markets can deter investors, affecting stock prices and, consequently, Zuckerberg’s personal net worth linked to his holdings in Meta.

The role of social media in shaping public opinion cannot be underestimated, especially as it relates to the financial consequences for Zuckerberg. Social media platforms like Facebook and Instagram have become powerful tools for influencing public sentiment, which in turn affects business dynamics.

Impact of Social Media on Public Opinion

Social media’s role in shaping public opinion creates a direct correlation to financial outcomes for Zuckerberg. The dynamics of user engagement and content dissemination can have substantial effects on the business model of Meta. Consider the following points:

- Brand Influence: As social media remains a primary source for news and information, public perception can directly impact advertisers’ willingness to spend money on these platforms.

- Public Relations Crises: Negative publicity, whether due to data breaches or ethical concerns, can lead to a loss of user trust, resulting in decreased engagement and subsequently lower advertising revenues.

- Market Trends: Trending topics can quickly shift public opinion, affecting how brands choose to advertise and interact with consumers on these platforms.

- Regulatory Responses: Public backlash against perceived mismanagement could lead to stronger regulatory actions, which might stifle growth or increase operational costs.

In summary, global events can create both crises and opportunities that directly impact Zuckerberg’s businesses. Understanding these dynamics is essential to forecasting his net worth in 2026.

Potential Crises and Opportunities

The landscape of global events continuously evolves, offering distinct challenges and opportunities for Zuckerberg and Meta. Identifying potential scenarios can help in anticipating how his wealth might be affected:

- Technological Advancements: Rapid advancements in technology, such as AI and VR, present opportunities for growth if Meta can leverage these effectively.

- Global Health Crises: Events like pandemics can shift user behavior, increasing reliance on social media for communication and commerce, which can enhance revenues.

- Geopolitical Alliances: Improved relations between major economies may open new markets for Meta, leading to increased user acquisition and advertising revenue.

- Cybersecurity Threats: Rising concerns over digital security can lead to costly breaches, potentially damaging Meta’s reputation and financial standing.

Illustrate the significance of personal investments and asset diversification for Mark Zuckerberg’s wealth

Mark Zuckerberg, the mastermind behind Facebook, has not only amassed significant wealth through his primary venture but has also strategically built his fortune through personal investments and asset diversification. These practices play a crucial role in managing financial risk and ensuring sustained growth in wealth over time. By focusing on various investment avenues, Zuckerberg exemplifies how high-net-worth individuals can enhance their financial security and capitalize on emerging market trends.Strategic investments are pivotal in shaping the financial landscape for billionaires like Mark Zuckerberg.

Known for his forward-thinking approach, Zuckerberg invests in a range of sectors, including technology, real estate, and healthcare. This diversified strategy not only enhances his financial portfolio but also aligns with his vision of supporting innovative technologies that could reshape the future.

Types of Investments and Their Strategic Importance

Zuckerberg’s investment approach includes several key areas, each contributing to the robustness of his portfolio. The significance of these investments can be highlighted through the following points:

- Technology Startups: Zuckerberg has invested in various tech startups through his venture capital firm, Breakthrough Initiatives. Such investments allow him to stay at the forefront of innovation and potentially reap high returns as these companies grow.

- Philanthropic Ventures: Through the Chan Zuckerberg Initiative, Zuckerberg invests in education and health. This not only contributes to societal growth but also enhances his public image, potentially leading to increased business opportunities.

- Real Estate: Zuckerberg has invested in high-value real estate, including properties in Palo Alto and San Francisco. Real estate often serves as a stable investment, providing both appreciation and rental income.

- Cryptocurrencies and Blockchain Technology: With the growing prominence of blockchain, Zuckerberg has shown interest in these technologies, indicating a strategic move to diversify his portfolio into emerging financial genres.

Asset diversification offers numerous advantages, particularly for individuals with significant wealth. By spreading investments across various asset classes, Zuckerberg can mitigate risks associated with market volatility. This strategy ensures that if one investment underperforms, others may still provide profitable returns, ultimately safeguarding his overall wealth.

Examples of Zuckerberg’s Investment Portfolio and Growth Potential by 2026

Zuckerberg’s diversified portfolio is a testament to his financial acumen. Some notable examples include:

- Investments in AI and Tech: As AI technology continues to evolve, Zuckerberg’s investments in companies focused on artificial intelligence are expected to yield substantial growth by 2026. Companies like OpenAI and other innovative startups could potentially revolutionize various industries.

- Healthcare Innovations: With significant investments in biotech firms, the growth potential in this sector is immense, especially as advancements in healthcare technology gain traction.

- Real Estate Appreciation: The real estate market has shown resilience, and properties acquired by Zuckerberg in prime locations are projected to appreciate significantly over the next few years, contributing to his net worth.

Investing wisely and diversifying assets not only creates a safety net against economic downturns but also positions Mark Zuckerberg favorably for substantial gains leading into 2026. As he continues to navigate the investment landscape, his portfolio stands as a model for aspiring entrepreneurs and investors alike, illustrating the importance of strategic planning and risk management in wealth accumulation.

Epilogue

As we reflect on Mark Zuckerberg’s net worth projection for 2026, it’s evident that his financial journey is intertwined with both personal and global developments. From strategic business decisions to philanthropic endeavors, each facet contributes to a dynamic net worth that is likely to evolve with emerging technology and market shifts.

Quick FAQs

What is Mark Zuckerberg’s estimated net worth for 2026?

While exact figures are speculative, projections suggest his net worth could see significant growth depending on Meta’s performance and market trends.

How does Zuckerberg’s philanthropy affect his wealth?

His philanthropic efforts can impact public perception positively but may also influence future business opportunities and personal wealth accumulation.

What technologies is Zuckerberg investing in?

Zuckerberg is known to invest in artificial intelligence, virtual reality, and other tech innovations that promise substantial returns.

How do global events influence Zuckerberg’s net worth?

Geopolitical issues and economic shifts can directly affect his wealth by impacting Meta’s market position and user engagement.

How does Zuckerberg’s net worth compare to other tech billionaires?

His wealth trajectory can vary significantly compared to peers, influenced by distinct business strategies and market dynamics.