With elon musk total net worth at the forefront, we delve into the fascinating financial journey of one of the most influential figures in tech today. Elon Musk’s story is not just about the numbers but also about the innovations, risks, and public perceptions that have shaped his remarkable wealth.

This exploration will take us through a detailed timeline of Musk’s financial milestones, the companies that have fueled his wealth, and the investment strategies he has employed. Additionally, we’ll take a look at how his net worth compares to other tech billionaires and the impact of philanthropy on his financial standing.

Explore the evolution of Elon Musk’s financial journey over the years.

Elon Musk’s financial evolution is a story marked by innovation, risk, and remarkable growth. From his early ventures to becoming one of the world’s wealthiest individuals, Musk’s journey is a fascinating case of entrepreneurial spirit and relentless ambition. His trajectory reflects not only his personal success but also the transformative impact of technology on global economies.The timeline of Musk’s financial journey illustrates key milestones that significantly impacted his net worth.

Notably, several events in his career have led to dramatic shifts in wealth, often correlated with the rise and fall of his various businesses. Below is a detailed timeline highlighting these pivotal moments.

Financial Milestones in Elon Musk’s Career

The following points Artikel crucial milestones that shaped Elon Musk’s financial landscape:

- 1995: Zip2 Corporation

-Musk co-founded Zip2, a city guide software for newspapers. In 1999, Compaq acquired Zip2 for approximately $307 million, resulting in Musk receiving $22 million from the sale. - 1999: X.com and PayPal

-Musk founded X.com, which later became PayPal after a merger. eBay purchased PayPal in 2002 for $1.5 billion in stock, adding around $165 million to Musk’s net worth. - 2002: SpaceX

-Musk founded SpaceX with an initial investment of $100 million. The company’s success in reducing launch costs and securing contracts with NASA significantly increased his wealth over time. - 2004: Tesla Inc.

-Musk invested $7.5 million in Tesla, eventually becoming CEO. By 2020, Tesla’s market capitalization soared, contributing billions to Musk’s net worth as the company became a leader in electric vehicles. - 2012: SolarCity

-Musk’s involvement with SolarCity, which was later acquired by Tesla, played a role in his financial portfolio, aligning with his vision for sustainable energy. - 2020: Billionaire Status

-Due to the skyrocketing stock price of Tesla, Musk’s net worth exceeded $100 billion for the first time in July 2020, making him one of the richest people in the world. - 2021: Peak Valuation

-Musk’s net worth reached an estimated $300 billion in November 2021, primarily driven by Tesla’s valuation and his stakes in SpaceX and other ventures. - 2023: Market Fluctuations

-As of early 2023, Musk’s net worth has experienced fluctuations, impacted by stock market conditions, Tesla’s performance, and global economic factors.

The growth of Musk’s wealth can be illustrated with compelling statistics. For instance, from 2018 to 2021, Musk’s net worth increased by over 1,000%, primarily due to Tesla’s stock performance. In early 2021, Musk briefly surpassed Jeff Bezos as the world’s richest person, underscoring the volatility and competitiveness in the tech billionaire sphere.Musk’s financial journey is a testament to the intersection of innovation, risk-taking, and market dynamics.

His ability to pivot and adapt in the ever-evolving tech landscape has not only reshaped his fortune but also transformed industries worldwide. As he continues to push the boundaries of technology and entrepreneurship, his financial narrative remains one of the most compelling stories of our time.

Analyze the major companies contributing to Elon Musk’s total net worth.

Elon Musk, a name synonymous with innovation and entrepreneurship, has amassed a staggering net worth primarily through his involvement in several high-profile companies. Each of these ventures plays a crucial role in shaping his wealth, fueled by innovative products and market performance. This analysis will delve into the major companies associated with Musk, their financial trajectories over recent years, and the impact of their innovations on increasing his net worth.

Tesla, Inc.

As one of the foremost electric vehicle manufacturers globally, Tesla has been a cornerstone of Elon Musk’s wealth. The company’s focus on sustainable energy solutions and cutting-edge automotive technology has led to impressive financial growth.

- In 2020, Tesla’s revenue reached $31.5 billion, reflecting a 28% increase from the previous year.

- By 2021, the company delivered nearly 1 million vehicles, further boosting its market valuation to over $800 billion.

- As of 2022, Tesla maintained a strong position, achieving a market cap of around $1 trillion at its peak, driven by investor enthusiasm for electric vehicles and renewable energy trends.

Tesla’s innovations, such as the introduction of the Model 3 and advancements in battery technology, have not only solidified its position in the automotive industry but also significantly contributed to Musk’s net worth.

SpaceX

SpaceX, founded by Musk in 2002, has revolutionized the aerospace industry, emphasizing cost-effective and reusable rocket technology. The company has experienced remarkable growth, directly influencing Musk’s wealth.

- With a valuation of approximately $137 billion in 2021, SpaceX has secured numerous contracts with NASA and commercial satellite launches, contributing significantly to its revenue.

- The successful deployment of the Starlink satellite constellation aims to provide global internet coverage, opening new revenue streams expected to enhance financial performance.

The consistent technological advancements and successful missions have positioned SpaceX as a leader in space exploration and satellite technology, greatly enhancing Musk’s overall financial standing.

The Boring Company

Although smaller in scale compared to Tesla and SpaceX, The Boring Company, founded to innovate urban transportation through tunneling, has shown promising growth potential.

- With contracts for various tunneling projects, the company’s valuation reached about $5.7 billion in 2022.

- The company’s successful completion of projects like the Las Vegas Convention Center Loop showcases its commitment to reducing urban traffic congestion.

Innovations in tunneling technologies have the potential to drastically change transportation infrastructure, further increasing Musk’s financial gains.

Neuralink

Neuralink, a neurotechnology company founded by Musk in 2016, focuses on developing brain-machine interface technology.

- While still in its early stages, the company has raised over $363 million in funding, with expectations that successful breakthroughs could lead to significant financial returns.

- Innovations aimed at treating neurological conditions may open lucrative markets in healthcare and technology integration.

The transformative potential of Neuralink’s products could position Musk favorably in the emerging neurotechnology sector.

SolarCity

Acquired by Tesla in 2016, SolarCity remains a pivotal component of Musk’s ventures, focusing on solar energy solutions.

- Despite facing challenges, the solar segment has contributed to Tesla’s diversification, particularly in the context of renewable energy investments.

- The company’s revenue has been bolstered by increasing interest in solar solutions, contributing positively to Musk’s overall net worth.

Innovative solar products, such as solar roofs, have the potential to enhance sustainability and profitability, further solidifying Musk’s financial base.

The combination of innovative technology and strategic management across these companies highlights their impact on Elon Musk’s extraordinary wealth.

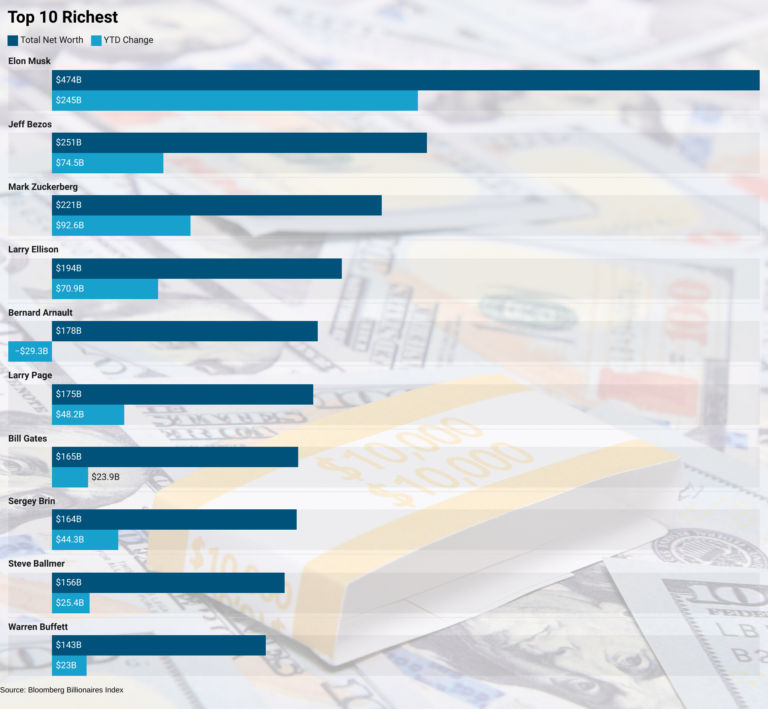

Compare Elon Musk’s net worth with that of other tech billionaires.

Elon Musk’s net worth has been a focal point of discussions regarding wealth in the tech industry. As of the latest estimates, Musk holds one of the top positions among global billionaires, significantly influenced by the performance of his companies like Tesla and SpaceX. Understanding how Musk’s wealth compares to that of other tech titans offers insights into unique business strategies and market trends.Musk’s approach to wealth accumulation is distinct from his peers, characterized by high-risk investments and groundbreaking ventures.

While many billionaires amass wealth through stable revenue streams, Musk often relies on visionary projects that can swing with market conditions.

Comparison with Notable Tech Billionaires

To contextualize Musk’s financial stature, it’s valuable to compare him with other prominent figures in the tech sector. Here are some notable tech billionaires and their net worth as of recent data:

- Jeff Bezos: The founder of Amazon, Bezos has consistently ranked as one of the wealthiest individuals globally, with a net worth around $180 billion. His wealth largely stems from e-commerce, cloud computing, and media ventures.

- Bill Gates: Co-founder of Microsoft, Gates has a net worth of approximately $120 billion. His wealth accumulation is attributed to software development and a robust investment portfolio, including philanthropy through the Bill & Melinda Gates Foundation.

- Mark Zuckerberg: The CEO of Meta Platforms (Facebook), Zuckerberg’s net worth hovers around $100 billion. His wealth is derived from social networking and advertising, although it has fluctuated due to market sentiment affecting tech stocks.

The differences in how these billionaires have built their fortunes highlight Musk’s unique position. He often ventures into uncharted territories, such as space exploration and renewable energy, which commands both admiration and skepticism.

“Elon Musk’s business strategies frequently involve high stakes and innovative technology, setting him apart from more traditional approaches in the tech industry.”

Market trends significantly influence the net worth of tech entrepreneurs. For instance, advancements in artificial intelligence, shifts in consumer behavior, and global economic conditions can lead to sharp fluctuations in stock prices, directly impacting the wealth of these billionaires. Musk’s net worth, in particular, is highly correlated with Tesla’s stock performance, which can experience rapid changes based on market sentiment and production milestones.

In summary, while Musk competes closely with other tech billionaires, his distinctive strategies and the volatile nature of the industries he operates in often put him in a class of his own, reflecting both the potential and risks associated with revolutionary business ventures.

Identify the investment strategies that have shaped Elon Musk’s financial portfolio.

Elon Musk is widely recognized not only for his visionary ideas but also for his strategic investments that have significantly shaped his wealth. His approach to investment has been characterized by a blend of innovation, conviction in technology, and a willingness to embrace risk. This combination has enabled him to build a diverse portfolio that reflects his ambitions and insights into future trends.Musk’s investment strategies have spanned various sectors, primarily focusing on technology, energy, and transportation.

His ventures, including Tesla and SpaceX, are not just products of entrepreneurial spirit but also results of calculated financial maneuvers. He often invests his own money into his startups, which illustrates his belief in the projects he undertakes. Musk’s approach to risk is particularly noteworthy; he tends to invest in industries that are disruptive or in their nascent stages, often betting on innovations that align with his vision for humanity’s future.

Investment Avenues Pursued by Musk

Musk has explored multiple investment avenues throughout his career, significantly influencing his financial landscape. Here are some key areas where he has made notable investments:

- Technology Startups: Musk has invested in various tech companies, including PayPal, which laid the foundation for his wealth. His early ventures into software and online payments showcased his foresight into the digital economy.

- Renewable Energy: His commitment to sustainable energy is evident through investments in companies like SolarCity, which he later merged with Tesla. This move not only diversified his portfolio but also aligned with his vision for a sustainable future.

- Aerospace: SpaceX, founded by Musk, represents a massive investment in the aerospace sector. His vision for space exploration and eventual colonization of Mars underscores his long-term investment strategy in high-risk, high-reward ventures.

- Artificial Intelligence: Musk co-founded OpenAI to ensure that AI technology develops in a way that benefits humanity. This investment reflects his belief in the potential of AI to revolutionize industries.

Risk Approach and Its Impact on Wealth

Musk’s approach to risk can be characterized as calculated and aggressive. He frequently puts a substantial portion of his wealth into his ventures, often risking personal funds during challenging times. This strategy has dual effects: when ventures succeed, they multiply his wealth exponentially; when they falter, they can lead to significant financial repercussions. His willingness to endure risk is exemplified by his decision to invest nearly all his earnings from PayPal into Tesla and SpaceX, which was a gamble that ultimately paid off.

“Musk’s investments are not just financial; they are a reflection of his commitment to innovation and a better future.”

Notable Investment Failures and Successes

Musk’s investment journey has seen its share of both triumphs and setbacks. Some notable successes include Tesla, which has revolutionized the automotive industry and skyrocketed Musk’s wealth, making him one of the richest individuals globally. SpaceX has also achieved significant milestones, including reusable rockets, which have reduced costs and made space travel more accessible.However, Musk has faced failures as well.

The SolarCity acquisition drew criticism and financial strain during its integration into Tesla. Additionally, some projects, like the Hyperloop, while visionary, have struggled to gain traction and deliver on initial promises. These experiences highlight the volatile nature of innovative investments and Musk’s resilience in navigating both successes and challenges.

Discuss the impact of public perception and media coverage on Elon Musk’s net worth.

Elon Musk’s net worth, which has fluctuated dramatically over the years, is not only tied to the performance of his companies but also heavily influenced by public perception and media coverage. As a prominent figure in technology and business, Musk’s actions, statements, and overall image play a crucial role in shaping his financial landscape. Public image and media portrayal have a significant impact on Musk’s financial standing.

For instance, positive media coverage can lead to increased investor confidence and a surge in stock prices, while negative press can result in sharp declines. Musk’s relationship with the media is complex; he often engages directly with the public through platforms like Twitter, which can amplify the effects of media narratives.

Influence of Media Coverage on Stock Prices

Several instances illustrate how media coverage has influenced Musk’s net worth through stock price fluctuations. In 2018, Musk’s infamous tweet about taking Tesla private at $420 led to immediate repercussions. The media frenzy surrounding the tweet not only captured the attention of investors but also resulted in a significant drop in Tesla’s stock price after regulators intervened, showcasing how a single media event can alter financial standings.

Similarly, during the COVID-19 pandemic, Musk downplayed the virus’s impact, which led to mixed media coverage. Some investors were optimistic, fueling a rise in stock prices, while others were concerned, leading to volatility. The relationship between Musk’s social media presence and net worth is particularly noteworthy. His frequent updates and tweets often sway public sentiment, resulting in rapid changes in Tesla’s stock valuation.

“Social media has transformed the landscape of public relations, and for Musk, it serves as both a megaphone and a double-edged sword.”

The following points summarize the main ways Musk’s social media activity affects his net worth:

- Tweets as Market Movers: Musk’s tweets about Tesla or cryptocurrency can lead to immediate spikes or drops in stock prices, demonstrating the power of his social media influence.

- Public Engagement: His direct engagement with followers creates a loyal fan base that can positively impact stock prices by boosting investor sentiment.

- Controversial Statements: Musk’s tendency to make provocative statements can result in negative press, leading to market volatility and potential losses.

Create a projection of Elon Musk’s future net worth based on current trends.

Elon Musk has been a dominant figure in the tech and automotive industries for years, rapidly accumulating wealth through his ventures in companies like Tesla, SpaceX, Neuralink, and The Boring Company. As we look toward the future, several economic factors and growth industries could significantly affect Musk’s net worth in the coming years.The global economy is influenced by various factors including market trends, technological advancements, and consumer behaviors.

With the increasing emphasis on renewable energy and sustainable technologies, Musk’s investments may be propelled by these shifts. Additionally, government policies regarding clean energy and space exploration could provide further financial opportunities. As Musk continues to innovate and expand his business portfolio, his net worth may see substantial fluctuations based on these economic indicators.

Economic Factors Influencing Wealth

Several economic factors are likely to have an impact on Musk’s wealth trajectory. Understanding these factors helps gauge potential future scenarios for his net worth.

- Global Economic Growth: An increase in global GDP can lead to higher demand for electric vehicles and renewable energy solutions, benefiting Tesla and SolarCity.

- Interest Rates: Rising interest rates can increase borrowing costs for companies, influencing investments in new projects, potentially slowing down expansion efforts.

- Regulatory Environment: Policies supporting climate change initiatives and space exploration can create new market opportunities for Musk’s enterprises.

- Technological Advancements: Innovations in battery technology and AI could enhance Tesla’s product offerings or lead to new revenue streams for SpaceX and Neuralink.

Potential Growth Industries

Elon Musk’s investment strategies may gravitate toward several burgeoning sectors. Identifying these areas can clarify the avenues through which his wealth may expand.

- Renewable Energy: As the world shifts toward sustainable energy sources, companies focusing on solar energy, wind power, and energy storage will likely see significant growth.

- Space Exploration: The commercial space industry is on the rise, with Musk’s SpaceX at the forefront, aiming for ambitious projects like Mars colonization and satellite internet through Starlink.

- Artificial Intelligence: As AI becomes increasingly integrated into various sectors, investments in AI technologies could yield substantial returns.

- Transportation Solutions: Innovations in electric vehicles, public transport, and autonomous vehicles continue to evolve, providing Musk with numerous opportunities to invest and expand.

Future Net Worth Scenarios

Based on current trends and potential economic developments, we can Artikel various scenarios that reflect different financial outcomes for Musk’s net worth. The table below demonstrates how various market conditions could impact his overall wealth by 2025.

| Scenario | Market Conditions | Projected Net Worth (USD) |

|---|---|---|

| Optimistic | Strong global economic growth, favorable regulations for clean energy and space | $300 billion |

| Moderate | Steady growth with mild regulatory challenges | $200 billion |

| Pessimistic | Economic downturn, increased competition, stringent regulations | $150 billion |

“Elon Musk’s wealth is intrinsically linked to the markets in which he operates, making accurate forecasting challenging yet essential.”

Elaborate on the philanthropic efforts of Elon Musk and their effect on his finances.

Elon Musk, widely known for his ventures in technology and space exploration, has also made significant strides in philanthropy. His charitable initiatives reflect his commitment to address pressing global issues while influencing his financial landscape. Through various donations and foundations, Musk has sought to leverage his wealth for the greater good, which in turn shapes public perception of his financial status.Musk’s philanthropic efforts encompass a variety of causes, including renewable energy, education, and health.

Among the key initiatives are:

Key Charitable Initiatives

To understand the breadth of Musk’s philanthropic activities, it is important to recognize the diverse areas he has chosen to support. Each initiative not only showcases his values but also carries financial implications that can influence his overall net worth.

- Nonprofit Organizations: Musk has committed to causes such as the X Prize Foundation and the Musk Foundation, which focus on renewable energy, science, and technology education. His donations to these organizations often amount to millions, impacting his liquidity but also generating goodwill.

- Disaster Relief Donations: Following natural disasters, Musk has pledged substantial amounts to relief efforts. For instance, his contributions to hurricane relief efforts in Puerto Rico highlighted his responsiveness to urgent humanitarian needs.

- Climate Change Initiatives: Musk’s environmental focus is evident in his support for projects aimed at combating climate change. His financial backing for solar energy initiatives represents a strategic investment in sustainable technology, aligning his philanthropy with his business interests.

- Education and Innovation Grants: Through the Musk Foundation, he has provided scholarships and funding for educational programs, particularly in science and technology, fostering innovation. This not only enhances his reputation but also creates a future workforce that could benefit his enterprises.

The financial implications of Musk’s charitable initiatives are multifaceted. While his donations can reduce his disposable income and affect his immediate wealth accumulation, they often enhance his reputation as a socially responsible entrepreneur. In many instances, philanthropy has the potential to yield favorable public relations outcomes that can indirectly bolster his business ventures, leading to increased investment and consumer loyalty.

Philanthropy can serve as a strategic tool for wealth accumulation, as it enhances public perception and fosters a favorable environment for business.

Public perception plays a crucial role in how Musk’s net worth is viewed. While some may argue that his philanthropic efforts demonstrate a genuine commitment to positive change, others view them as strategic maneuvers to soften scrutiny over his immense wealth. Regardless of perspective, it is clear that his charitable actions contribute to a complex narrative surrounding his financial status, often leading to divided opinions among the public.Through these initiatives, Musk not only addresses significant global challenges but also navigates the intricate intersection of philanthropy and wealth.

His approach illustrates how high-profile individuals can wield their financial resources for substantial societal impact while simultaneously influencing their economic standing and public image.

Last Point

In conclusion, understanding elon musk total net worth is more than a mere examination of figures; it’s a reflection of innovation, strategy, and public perception. As Musk continues to push boundaries in technology and business, the future of his wealth remains a subject of interest that intertwines with global market trends and personal initiatives.

FAQ

What is Elon Musk’s current total net worth?

As of the latest reports, Elon Musk’s total net worth fluctuates around $200 billion, depending on market conditions.

How has Elon Musk’s net worth changed over the years?

Musk’s net worth has seen significant growth, particularly during the rise of Tesla and SpaceX, often experiencing rapid increases and decreases due to market volatility.

What are the primary companies contributing to his net worth?

The primary companies contributing to Elon Musk’s net worth include Tesla, SpaceX, Neuralink, and The Boring Company, with Tesla being the most significant factor.

How do market trends affect his net worth?

Market trends greatly influence Musk’s net worth, as fluctuations in the stock prices of his companies can lead to substantial changes in his overall wealth.

Is Elon Musk involved in any philanthropic efforts?

Yes, Musk is active in philanthropy, supporting various initiatives, particularly in renewable energy, education, and space exploration, which also reflect on his public image and financial strategy.